Good Morning!

I hope everyone enjoyed the thrilling Super Bowl yesterday. Nothing like a defensive showdown, a lot of field-goals, and watching the game with a bunch of fans of the losing team to make for a truly memorable Super Bowl. But hey — at least the wings were elite.

And while the game itself left a lot to be desired, one person absolutely had a night: the videographer during the National Anthem. Arguably some of the best film work we’ve seen all year. If you weren’t focused on it in the moment, make sure to check it out here.

Showtime!

The Big Three: Anthropic vs. OpenAI, Alphabet, Sprouts Farmers Market

Chart of the Week: ChatGPT vs. Gemini

Sports Corner: The Beard Comes to The Land

Meme of the Week: The Future of Work… Apparently.

Two quick housekeeping announcements/reminders before we get started:

The Crossover is not investment advice and is for education and entertainment purposes solely.

Please see the full disclaimer at the bottom of the newsletter

Was this email forwarded to you?

THE BIG THREE

1. Anthropic vs. OpenAI: An Unexpected Next Chapter

Photograph via Anthropic

The News:

During the Super Bowl, Anthropic aired multiple advertisements emphasizing that Claude does not include advertising, contrasting this with ChatGPT, which has said it plans to introduce ads.

The ads depicted natural conversations with an implied AI assistant that subtly mocked ChatGPT’s “personality,” then abruptly shifted into a promotional message to highlight advertising as a potential interruption — and Claude as the alternative.

You can watch one of the ads here:

Alan’s Angle:

To date, Anthropic has largely built its reputation by taking a principled stance — prioritizing safety, reliability, and B2B use cases, while pursuing a more calculated, capital-efficient approach to growth.

That’s why these ads stood out as they feel like a real departure from that playbook and were pretty shocking to me.

It raises an interesting question: is Anthropic taking the gloves off and shifting toward the fight for the everyday consumer — the arena where ChatGPT and Gemini have been openly battling for market share? Definitely something to watch.

I also loved how Sam Altman handled the moment on X. He opened by saying he laughed and that the ads were funny — and then brought the heat. Lines like “I guess it’s on brand for Anthropic doublespeak” and “More Texans use ChatGPT for free than total people use Claude in the U.S.” were sharp, confident, and unmistakably on-brand.

The irony in all of this? Both of these companies are — and will continue to be — wildly successful (assuming OpenAI can keep its burn in check). Everyone involved will be very rich.

Everything else is just noise.

2. Alphabet: Sundar Keeps Crushing

Pictured: Sundar Pichai (Photograph via Jeenah Moon/Bloomberg)

The News:

Last week, Alphabet, Google’s parent company announced their Q4 earnings. Here were some of the key statistics:

Revenue: $113.8B, representing 18% growth YoY

Google Services: $95.9B, representing 14% growth YoY led by 17% growth in Google Search & other

YouTube: Exceeded $60B for FY 2025

Google Cloud: $17.7B, representing a 48% increase YoY

EPS: $2.82, representing a 31% increase YoY

Reflecting on the quarter, Alphabet CEO Sundar Pichai shared that the company had a “tremendous quarter” exeeding $400B in revenue for the first time. He also highlighted how Gemini now has 750 MAUs processing 10 billion tokens per minute via direct API use.

Alan’s Angle:

If The Crossover had an award ceremony, we would’ve named Sundar Pichai the CEO of 2025.

What an extraordinary year for Alphabet. With their backs against the wall and Google Search — one of the most dominant business models ever — seemingly facing an existential threat, Pichai’s ability to pivot a multi-trillion-dollar organization and create real urgency was remarkable.

Whether it’s Waymo’s explosive growth, the YouTube juggernaut that only is getting stronger, or the remarkable success of Gemini — which added 100M new users in the quarter alone — Alphabet is clearly rocking and rolling.

Waymo, in particular, continues to stand out to me. In December, the company surpassed 20 million fully autonomous trips and is now providing more than 400,000 rides every week. Whenever I’m in San Francisco, I always take Waymos — and I’m a massive fan.

I know this is an investment newsletter and we’re all here for Alan’s Angle, but the truth is the angle here isn’t novel. In my eyes, this is simply one of the greatest companies in the world — ever — with some of the best assets for the next decade.

Yes, the AI CapEx buildout is massive and expected to continue — roughly $175B to $185B, including $91.4B in near-term investment. But Alphabet can afford to make these bets from a position of strength and it should only compound their advantages.

I fully expect the company’s success to continue, and I would not be surprised at all if at some point in 2026 they were the most valuable company in the world.

3. Sprouts Farmers Market: A Stock I am Watching

Photograph via Sprouts Farmers Market

The News:

Sprouts Farmers Market is scheduled to report its Q4 and full-year earnings on February 19th.

Over the past year, the grocers stock is down more than 60% to roughly $67 per share, now trading at a market cap of about $6.5B.

Alan’s Angle:

For anyone who’s been reading my newsletters over the past few years, you know Sprouts is a company I really liked — and one I still can’t believe I ever sold.

Now, it feels like the heavens might be giving me another bite at the apple, with the stock down meaningfully over the past year.

Why am I intrigued? Because fundamentally, this is the exact type of business — and the exact type of investor profile — I aspire to own long term. Beautiful fundamentals. Disciplined capital allocation. Share buybacks. Solid management. A real, differentiated value proposition. Sometimes, all you have to do is wait.

At the same time, I’ve also been working hard to “un-boomerize” myself — leaning much more heavily into the AI revolution and higher-growth names. But at the end of the day, math is math. And growing free cash flow at a reasonable valuation will always be my middle name.

Through Q3, the company has generated $577M in cash (up from $520M last year YTD), repurchased $342M worth of stock, and in total expects to open 37 new stores this year.

Yes, Q4 guidance looks relatively light, with comparable-store sales growth expected in the 0–2% range. But this is still a company that is effectively printing cash, retiring millions of shares each year, and continuing to expand its footprint — with plenty of runway still ahead.

I’ll be watching their Q4 earnings very closely and don’t be surprised if you see a deeper dive on them from me soon!

CHART OF THE WEEK

ChatGPT vs. Gemini: Latest Developments

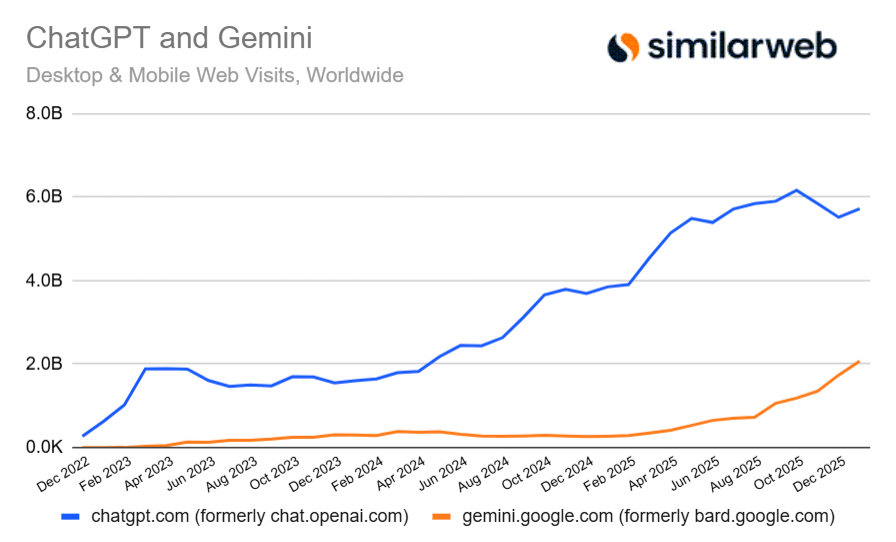

While many of the recent AI headlines have been focused on Gemini’s rise — which surpassed 2B visits this past month — it’s important to keep the sheer scale of ChatGPT in perspective. Even after coming off its peak, ChatGPT still generates roughly 3.5B+ more monthly visits than Gemini.

And while ChatGPT has seen some normalization from its highs, the platform returned to growth this past month after a couple of months of decline.

SPORTS CORNER

The Beard Comes to The Land

Pictured: James Harden (Photograph via AP)

If anyone happens to take a vacation to Cleveland, Ohio over the next couple of months (which I’m sure you’re all considering), don’t be surprised if you see a few extra beards running around town. That’s what happens when your basketball team trades for future NBA Hall of Famer James Harden — The Beard.

Coming into this season, the 10-year anniversary of the 2016 title, Cleveland fans truly thought this could once again be our year. The “Core Four” was back: two All-Star guards in Darius Garland and Donovan Mitchell, one of the brightest young stars in the NBA in Evan Mobley, and seven-footer Jarrett Allen. Add in an Eastern Conference that felt wide open — with devastating injuries to All-Stars Jayson Tatum and Tyrese Haliburton — and the path a Finals appearance was there.

But even with the Cavs getting hot over the past few weeks, the season had been a real disappointment. Championship aspirations were fading, and the team started to look less like a contender and more like the playoff disappointments we’ve unfortunately gotten used to over the past several years.

Thankfully, Cavs President of Basketball Operations Koby Altman and the rest of the front office saw this too.

Altman made a flurry of moves, adding exciting, dynamic talent — including gritty, athletic defender Keon Ellis and established veteran point guard Dennis Schröder — while also making moves to help clean up our not so pretty salary cap situation. But make no mistake: the acquisition of 11-time All-Star James Harden in a Darius Garland swap was the most important move of them all.

There will be growing pains, no doubt. But after watching the Cavs’ first game with Harden, this team clearly has a different energy — and a whole new level. Garland was fantastic and a fan favorite, but Harden operates with the same gravity as Mitchell, completely warping defenses. That not only takes pressure off Donovan, but it also opens up a world of lob opportunities for two athletic seven-footers flying to the rim.

Koby Altman deserves an A+ for this trade deadline. And for us Cavs fans? We can officially start dreaming about June.

P.S. Free idea for the Cavs promo team (which I’m sure you’ve already thought of): remember the Anderson Varejão wig nights? Yeah… let’s do it with The Beard.

P.P.S. LeBron will absolutely be back in Cleveland next year to wrap up his career.

MEME OF THE WEEK

The Future of Work… Apparently.

Thanks for the read! Let me know what you thought by replying back to this email.

— Alan

Disclaimer: The Crossover is not a professional financial service. All materials released from The Crossover are for educational and entertainment purposes. The Crossover is not a replacement for a professional's opinion. Contributors to the Crossover might have positions in the equities mentioned in the newsletter.