Good Morning!

I would publicly like to apologize to my roommates for my decibel levels this past week in the apartment. After being introduced to Christopher Tin's "Waloyo Yamoni", I have imagined a world where I was the lead singer.

This is not a world that you want to live in. Sadly, for my roommates, it was their world for the past 7 days.

Speaking of the roommate, Jacob and I are back for Episode #2 of The Crossover Pod! Inside we discuss Snapchat, Spotify, Meta, and a whole lot more! Give it a listen here!

Showtime!

Was this email forwarded to you?

DEEP DIVE

Penn Entertainment: A Solid Q4

Penn Entertainment

Share buybacks increase your interest in a company without having to buy more shares!

-My Dad, Chairman of the Board at The Crossover

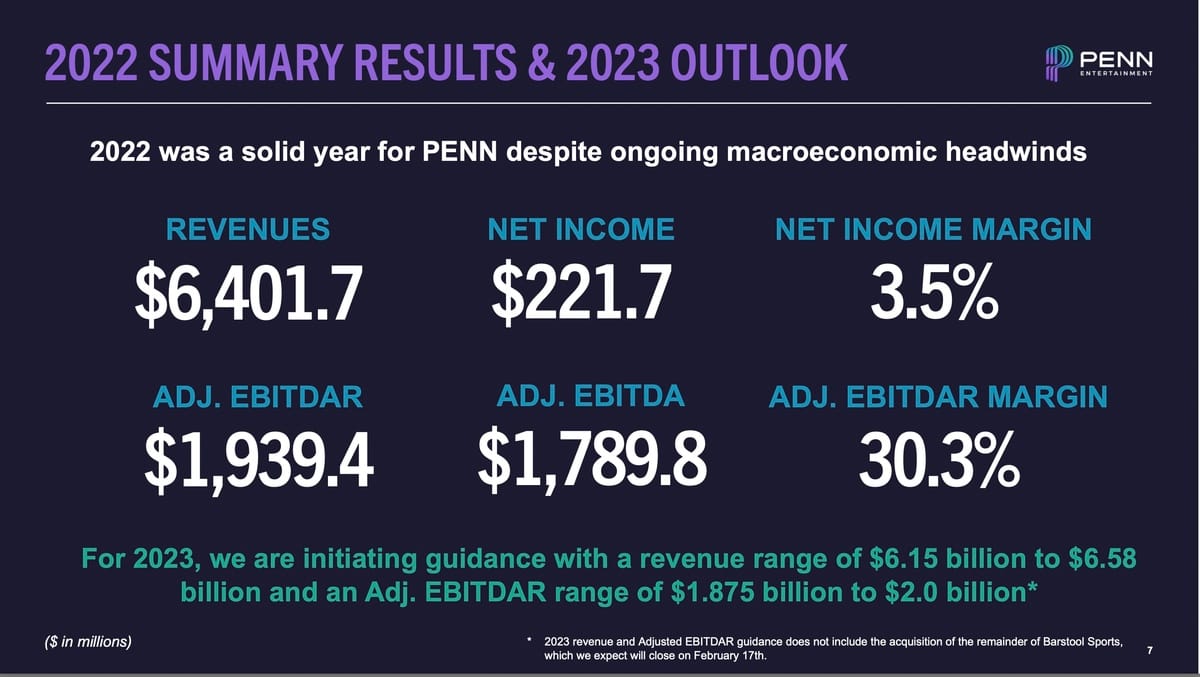

Yesterday, Penn Entertainment announced their fourth quarter earnings. Here were some of the key stats:

Revenue: $1.59B (Q4 ‘22) vs. $1.58B (Q4 ‘21)

EPS: $0.13 (Q4 ‘22) vs. $0.41 (Q4 ‘21)

Net Income: $20.8M (Q4 ‘22) vs. $45M (Q4 ‘21)

EBITDAR: $468M (Q4 ‘22) vs. $481M (Q4 ‘21)

As you can see, from a YoY perspective, there were bottom line misses across the board, but the top line remained solid.

Why? You ready for this? Because of bad weather. Actually.

Since $PENN’s core business is from regional casino’s, if people cannot travel to the casinos due to tough winter conditions, the fixed costs remain, the people do not show up, and the profits aren’t reaped.

The good news is that things really rebounded in the holiday season and $PENN put up a “much stronger January this year than last year.”

The miss on the bottom line is obviously frustrating, but the company still had a profitable quarter, and it is nice to see that the company can manage a storm (pun most definitely intended).

Penn Interactive

The most exciting developments to me from the quarter were around the interactive side of the business (iGaming and online sports gambling). Specifically, $PENN posted $280M in revenue from this segment in the quarter with $5M of EBITDA profit.

The $5M profit is an incredible figure especially when you take into account that DraftKings lost $450M on $500M in revenue in ‘Q3 22. It is clear that the organic marketing from Barstool and theScore is a differentiated advantage that is paying serious dividends.

On top of this, $PENN achieved profitability in this segment while launching in Ohio, one of their best launches to date, and Mattress Mack winning a $10M bet on the Astros in the World Series. Yes. Mattress Mack really did get a shoutout on the earnings call.

According to the company, with the recent launch in Massachusetts, the home of Barstool where $PENN should crush it, the company now has 31 retail sportsbooks in 14 states with a market share of 18% outside of Nevada.

CEO Jay Snowden shared that the company expects to earn $25M in EBITDA in this segment in 2023.

Another interesting development for Penn Interactive is with theScore. theScore is the Toronto based sports media company that $PENN acquired for $2B – around $1B in cash and $1B in $PENN stock in August ‘21.

According to Comscore, theScore is the #3 sports media brand in North America based off of monthly unique visitors ranking behind ESPN & Yahoo Sports and ahead of CBS Sports & Bleacher Report.

In October, $PENN integrated the Barstool Sportsbook into theScore giving sports fans the ability to gamble when they are checking scores of games and reading articles about their teams. I love it.

Additionally, theScore Bet (Canadian betting offering) was integrated into $PENN’s proprietary, fully owned tech stack as a test run before they do so with Barstool Sports. Not only does $PENN feel that owning every step of the tech stack will save them some costs, it will also enable them to to improve retention and promotion capabilities.

For example, the company shared that after theScore Bet was moved to $PENN’s tech stack, compared to the US business, they saw an approximately 85% increase in 3-month retention, an almost 20% improvement in our cross-sell rates to iCasino, and a 114 basis point increase in hold rates.

This should be big for the Barstool Sportsbook in the long run.

I continue to love the gambling space from an investment perspective as everyone I know that bets on sports on these apps loses. $PENN and $SRAD represent two profitable companies trading at reasonable multiples.

As you all know, the Holy Trinity of The Crossover is Free Cash Flow, Dividends, and Share Buybacks. Even though I am Jewish, I think I can say that. I am sorry Rabbi if I went too far.

$PENN announced that in Q4, they bought back $91M in stock at an average price of $31.69. Since the start of the year, they bought back another $31.5M at an average price of $31.20. In total that means in the past ~120 days, $PENN bought back over $120M in stock representing more than 2% of the market cap.

Powerful

$PENN now has a total of $117.8M and $750M on their respective February and December share repurchase authorizations remaining, representing just under 20% of the market cap. However, it does sound like the repurchases will be slowing down – especially in my eyes if the stock stays above $30.

Why?

In two weeks, $PENN will be completing their purchase of Barstool Sports – the 64% remaining interest for $388M in cash – which is on fire even in a tough digital ad market. With currently $1.6B in cash and traditional net debt of $1.1B, $PENN wants to keep a strong balance sheet.

There will likely still be share repurchases this year, but a whole lot less.

One interesting Barstool point – current revenue guidance and profitability for Penn does not take into account $PENN’s full ownership of Barstool. Sounds like in May we will hear a lot more from Jay and Erika Nardini, CEO of Barstool on their plans and the financials behind the business and overall company guidance.

I can’t wait.

Wrapping It Up

$PENN’s stock was down a few percent on the report, and to me, that sounds right based off the bottom line miss. It was hard seeing a red day for $PENN when everything was flying.

The general markets felt like peak 2021 again yesterday, but we are staying focused on what we do and how we do it. I am standing pat with The Crossover’s position in $PENN – I am not adding or selling at these levels.

What makes me the most confident in $PENN in the long run?

If Snowden does not get this stock price up, he will have an angry Portnoy on his hands and no one wants that.

-Alan

THE CROSSOVER ARCHIVE

Netflix, T-Bills, Rippling

Missed a recent edition? That's okay! Now you can just click on these links below to catch up on what you missed!

CHARTS OF THE WEEK

ARK & BTC, The Cleveland Fed, Retail Trading

PORTFOLIO

The Crossover Portfolio

Note: The Crossover Portfolio is a mock portfolio of how I would be investing and not with real money. All trades are shared publicly @ The Crossover Twitter as they are recognized.

Moves: Zero moves outside of putting 35% of our cash balance into 4.5% T-Bills. Will likely keep renewing this until opportunities we like present ourselves

$SPLK - Splunk laid off 4% of their staff

$PARA - Paramount announced that they would be combining Showtime with Paramount+

Also, for the new investors out there who are wondering how could there be so much green in the portfolio, but down overall? Last year, a couple of our big positions took big hits. We live and learn.

I still need to fix the portfolio weights... ugh.

The Crossover Pod

Tech Earnings: Snap, Spotify, Meta

The Rundown: In this week's pod, Jacob and I shared our thoughts on the earnings of Snap, Spotify, and Meta. We also discussed why Jacob had to take a one week vacation after our first episode. Below is a little teaser on our thoughts on Snap!

Snap Earnings:

Revenue: $1.30B (actual) vs. $1.31B (projected)

EPS: $0.14 (actual) vs. $0.11 (projected)

DAU: 375M (actual) vs. 375.3M (projected)

ARPU: $3.47 (actual) vs. $3.49 (projected)

Alan's Angle: Based on the numbers above, Snap's earnings don't look awful, so why was the stock down 10%? A couple of reasons:

Revenue Forecast: The main reason for the sell off IMO is really really bad forecasting for Q1 revenue that is calling for a YoY DECREASE in revenue of -10 to -2% in Q1 ‘23. Yikes. The digital ad market is nasty and Snapchat is taking it to the chin. If Snapchat isn’t a growth stock, then what is it? a value stock? I don’t think so… especially after reading point number 2.

FCF & SBC: If Free Cash Flow is my middle name, Stock Based Comp is the nickname I had in middle school that I didn’t like. If you do not keep a close eye on SBC, it can really skew the way you are looking at a company. For example, Snapchat had $78.3M in FCF in Q4 ‘22. Although this was down from $160M in Q4 ‘21, at least they were still profitable right? Not really as SBC sky rocketed to $450M in Q4 ‘22 vs. $297M in Q4 ‘21. $78M in FCF with $450M in SBC is a very very bad equation.

Did Snapchat have any good news in the quarter? Oh yes! But for that, you are going to have to check out the pod using this link here!

MEME OF THE DAY

GOLDEN NUGGETS

Loved this podcast with 76ers President of Basketball Ops Daryl Morey

Former star Texans RB Arian Foster said NFL was rigged

Tom Brady Retires!

Chamath on how long rates need to stay this high for

Dennis Schroeder half court shot!

The Jim Chanos interview on CNBC was great

Thanks for the read! Let me know what you thought by replying back to this email.

— Alan

Disclaimer: The Crossover is not a professional financial service. All materials released from The Crossover are for educational and entertainment purposes. The Crossover is not a replacement for a professional's opinion. Contributors to the Crossover might have positions in the equities in the The Crossover Portfolio or mentioned in the newsletter.