Good Morning!

On Tuesday Night, LeBron James passed Kareem Abdul-Jabbar to become the all-time leading scorer in NBA History.

As someone who was born and raised in Cleveland, Ohio, Lebron means a lot (too much) to me. At just 18 years old, he had the pressure of the world on him and 20 years later it is clear that he not only lived up to the expectations, but exceeded them too. Whether it is on the court, in his personal life, or in the community, Lebron is as good as they come.

Congratulations to the greatest to ever do it on this accomplishment.

Also - there will be no Crossover next week as I will be taking my first week off not writing a newsletter in over a year!

Showtime!

Was this email forwarded to you?

The Big Three

1. Bessemer Venture Partners & Toast

Bessemer Venture Partners does something really cool where they release investment memos from some of their best performing venture investments including household names like Pinterest, Shopify, Twitch, Linkedin, PagerDuty, and many others.

There was one in particular that jumped out to me and that is BVP’s investment in Toast’s (Crossover Portfolio Pick) Series B from 2015. The memo written by BVP partners Kent Bennett and Eric Ahlgren called for a $17.5M investment in the $24M round which would give BVP ~15% of the company.

Check out Bennett's and Ahlgren’s model for the Toast investment:

As you can see, they map out several scenarios of how they could see the investment playing out, but my favorite part is the “just goes nuts” part of the model in the bottom left. Why?

Because even the “just goes nuts” part of the model undersold what the investment ultimately could and would become.

Toast ultimately IPOd @ a $20B valuation in September ‘21, meaning that the IPO was 2.5x higher than BVP's wildest dreams. Including the fact that BVP invested in subsequent rounds of Toast, it looks as if this $17.5M investment swelled into well over $1B.

Venture Capital Baby.

Two other parts of the memo that I found interesting

Secret Shopper Visits

As you all know, I am a big believer in looking deep at the numbers AND getting out there to do real world DD and talking to the people on the ground. Looks like the best investors are big believers in it too:

“Beyond combing through their salesforce data, we have also spoken to 30 Toast customers – in addition to the 12 references provided by the company we did another ~20 “secret shopper” in-person visits.”

2. Patience

Sometimes for the best opportunities both in the public and private markets, you just have to be very patient:

“We’re very excited about this investment – for the past 18 months we’ve stood by anxiously as the team hit obvious product market fit but punted on raising more equity. Finally they’ve seen an opportunity to step on the gas, and frankly have seen the capital markets “rationalize” (okay, slightly) which has given us an opportunity to invest in a deal we can stomach.”

Beast.

Now, what do I really want to see from BVP? Some of their memos from investments that haven’t panned out, but that will likely never happen!

2. An Interest in Pinterest?

Pinterest is a stock I have followed for quite a while now going back to 2019. In the words of Ophir Gottleib of CML VIZ, Pinterest is the one social media platform that does not have hostility between users providing a unique value proposition for advertisers.

Additionally, over 70% of their user base is female and ~90% of users go to Pinterest with the intention of purchasing something. Unique and Interesting.

Pinterest released their earnings this past week and there was a lot to digest including:

Revenue: $877M (actual) vs. $887M (projected)

EPS: $0.29 (actual) vs. $0.27 (projected)

Returning Capital: Authorized a $500M Share Buyback

Executive Departure: CFO Todd Morgenfeld is leaving the company

Pinterest’s stock is down ~10% on earnings likely due to the $10M revenue miss and single digit revenue growth guidance for Q1.

I easily could have made today’s whole edition a breakdown of $PINS, but had some other stories I wanted to touch on, so I will just give Alan’s Angle on one component of their earnings. Check this out.

As you can see, Pinterest has displayed nice MAU growth over the past year. However, it is important to note where these MAUs are coming from. The US-CAN MAU growth is non existent (stable at 95M), Europe showed 2M MAU growth, and Rest of World grew by 16M.

I think we would all bet that the ARPU for US-CAN is greater than Europe and significantly greater than RoW, however, it is wild how big of a discrepancy it is:

US ARPU is around ~$7, Europe ~$1, and RoW ~$0.10. What this means is that even though RoW is growing significantly, it has minimal impact on the top and bottom line. Rather, the component of the business that would lead to significant earnings growth (US), is displaying no growth at all.

The bulls could argue the low ARPU of 355M non-US-CAN users is a great opportunity, however, the lack of ARPU growth, stiff competition from other social media companies, and uncertain macro environment make this one a pass for me.

3. Iger Back with a Bang!

On Wednesday late afternoon, I was at the gym thinking that I was going to be able to get a good workout in while listening to Disney’s earnings call. I had an awful workout. Why? Because Iger was dropping bomb after bomb and the call had 100% of my attention.

How bad was my workout? I found myself barely pedaling on a stationary bike burning a calorie a minute.

Again. This could be the whole edition today, but I wanted to discuss the other stories I did before.

Here were some of the notable takeaways from the call:

Disney is putting in place $5.5B in cost cutting measures ($3B in content cuts)

Laying off 7,000 employees (~3% of workforce)

Re-affirming profitability for streaming in late ‘24

Re-instituting Dividend, albeit significantly smaller than pre-COVID

Reorganizing the company into 3 silos: Disney Entertainment, ESPN, and Parks, Experiences, and Products

See ESPN as a core part of the company moving forward and not looking to sell the asset

Iger came out swinging, and in my eyes, showed there is no need for Peltz to be on board. I do not see how a Disney bull could have asked for anything more from the call.

I am also disappointed by the large media outlets by the way they covered Disney’s earnings.

My Twitter feed was covered with “Disney+ loses 2.4M streaming subscribers in Q4.” Although this is true, the title is very click baity and misleading.

Core Disney+ subscriptions grew from 102.9M to 104.3M in the quarter (46.6M domestic and 57.7M international), ESPN+ subs grew from 24.3M to 24.9M, Hulu subs grew from 42.8M to 43.5M. Not a Netflix quarter for Disney streaming, but still net positive.

The headline came from the fact that Disney+ Hotstar, the company’s Indian based streamer dropped from 61.3M to 57.5M after losing the coveted cricket streaming rights to Reliance.

Why is this not a big deal? Because Hotstar’s ARPU was $0.74 a user vs. the $5.77 of Disney+ Core, $5.53 of ESPN+, and $12.46 of Hulu.

Disney streaming had a net revenue positive growth quarter, and that is why it is important to not just trust the headlines!

A couple additional side notes:

It sounds like the ad market continues to be weak which is bad news for not only the economy, but other media/ digital advertising companies.

It has become clear from many tech companies, and specifically in the media space, is that there is a lot of fat that can be trimmed at these companies, and although it hurts, trimming they are.

I continue to believe that they will figure out how to generate significant profits in the streaming era, and Disney’s earnings supported this belief.

Content is king and the media companies have it.

THE CROSSOVER ARCHIVE

Netflix, T-Bills, Rippling

Missed a recent edition? That's okay! Now you can just click on these links below to catch up on what you missed!

02/07 - Penn Entertainment: A Solid Q4

CHARTS OF THE WEEK

1. Startup Valuation Update

2. Robinhood MAU Decrease

3. Labor Force Participation

VENTURE CAPITAL

Triple Whale Series B

The Rundown: Triple Whale, a comprehensive analytics platform that operates on Shopify, announced a $25M Series B led by NFX and Elephant.

Key Points:

Triple Whale helps their customers track anything and everything regarding their Shopify store aiming to improve conversion rates, marketing campaigns, and ultimately help companies become more profitable

Triple Whale grew by 1,400% growth YoY and now has 5,000+ brands using their platform who in total did over $14B in revenue

The company was created by CEO AJ Orbach by taking the systems he used to track his D2C companies and creating a product around it. Triple Whale really took off after Apple's IOS changes in 2020 and Facebook's data became a lot less reliable.

Alan's Angle:

I really like Triple Whale and they have a lot going for them that I look for in companies. One of my favorite signs with the company is that NFX led their seed round and Elephant led their Series A, meaning that the two investors are very pleased with how things are going at Triple Whale.

I also love that Shopify has "strategic participation" in this round. When your company lives on someone else's platform, it is integral to have their support and aligned incentives. Shopify is one of the most powerful platforms on the planet and it seems like that Triple Whale is embedded pretty deeply.

I would not be surprised to see Shopify one day acquire Triple Whale outright.

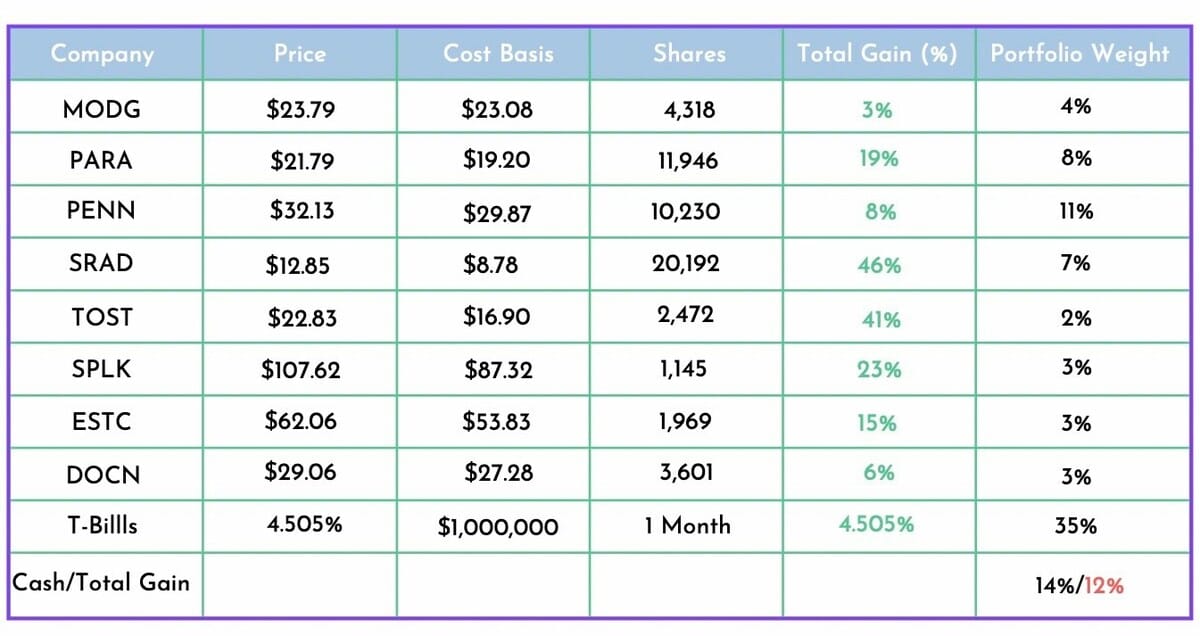

PORTFOLIO

The Crossover Portfolio

Note: The Crossover Portfolio is a mock portfolio of how I would be investing and not with real money. All trades are shared publicly @ The Crossover Twitter as they are recognized.

MEME OF THE DAY

GOLDEN NUGGETS

Really enjoyed the Squawk Box crews conversation on $DIS earnings!

Knicks PG Jalen Brunson figuring out he is being reunited with college teammate Josh Hart is awesome

Loved this piece from Contrary Capital GP Kyle Harrison on "The Hype Cycle" of AI

Dragan Bender jerseys are officially back!

Sneak peak at next week's meme of the week!

Thanks for the read! Let me know what you thought by replying back to this email.

— Alan

Disclaimer: The Crossover is not a professional financial service. All materials released from The Crossover are for educational and entertainment purposes. The Crossover is not a replacement for a professional's opinion. Contributors to the Crossover might have positions in the equities in the The Crossover Portfolio or mentioned in the newsletter.